VA vs Conventional loans

VA Loan vs Conventional Loan Comparison

✅ Quick Answer: VA Loan vs Conventional Loan

The primary distinction between a VA loan and a conventional loan lies in their approach to down payments, mortgage insurance, and credit flexibility. VA loans often allow $0 down and no monthly PMI for eligible veterans, while conventional loans typically require a down payment and may include private mortgage insurance.

🏡 Comparing VA and Conventional Loans

Both loan types can be excellent options depending on eligibility, credit profile, and long-term goals. Understanding the differences helps buyers make informed decisions in competitive local markets.

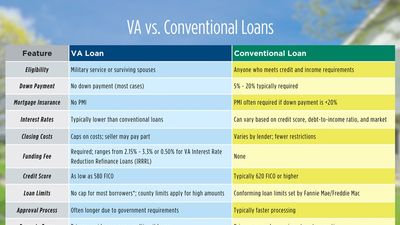

📊 VA Loan vs Conventional Loan: Side-by-Side Comparison

🎖️ VA Loans – Key Considerations

VA loans are backed by the U.S. Department of Veterans Affairs and are designed to make homeownership more attainable for eligible military borrowers.

VA loans work well when:

- You qualify based on military service

- You want to minimize upfront cash

- You prefer no monthly mortgage insurance

- You’re buying a primary residence

VA loans are commonly utilized by both first-time and repeat buyers

🏠 Conventional Loans – Key Considerations

Conventional loans are not government-backed and are widely used by buyers with strong credit profiles.

Conventional loans may be a better fit if:

- You don’t qualify for VA eligibility

- You’re buying a second home or investment property

- You plan to put down a larger down payment

- You want flexibility with property type

Conventional loans remain popular across Upstate South Carolina, especially in higher-price markets, with many turning to Greenville SC mortgage companies for assistance.

⚠️ Common Misconceptions About VA vs Conventional Loans

❌ “VA loans are harder to close”

❌ “Sellers don’t like VA loans”

❌ “VA loans are only for first-time buyers”

In reality, the best loan depends on how it’s structured and matched to the buyer’s goals—especially in competitive Greenville-area markets.

❓ VA vs Conventional Loan FAQs –

Is a VA loan always better than a conventional loan? Not always. VA loans are powerful for eligible buyers, but conventional loans can be better in some situations.

Do VA loans take longer to close than conventional loans? No. When properly structured, VA loans often close on similar timelines.

Can first-time buyers use either loan? Yes. First-time buyers may qualify for VA or conventional loans depending on eligibility.

Can I switch from a conventional loan to a VA loan later? Possibly. Eligibility and entitlement availability matter.

🔗 Related Mortgage Resources

- VA Home Loans

- VA Loan Eligibility Guide

- First-Time Home Buyer Programs

📞 Compare VA vs Conventional Loans With a Local Expert

Choosing between a VA loan and a conventional loan is easier with local guidance from experienced mortgage brokers.

Jed Barker and Best Life Mortgage assist buyers across Greenville, South Carolina, and Upstate South Carolina in comparing loan options, understanding trade-offs, and moving forward with confidence.

📱 Call or text 864-800-9251 when you’re ready.

Best Life Mortgage

VA & Conventional Loans | Greenville, South Carolina Serving Upstate South Carolina with clear comparisons and local expertise.

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.