VA Loan Eligibility Guide

Who Is Eligible for a VA Loan?

You may be eligible for a VA home loan if you are an eligible veteran, active-duty service member, National Guard or Reserve member, or a qualifying surviving spouse. VA loan eligibility is based primarily on military service history, not income level or first-time buyer status.

VA Loan Eligibility for Veterans

Veterans throughout Greenville, South Carolina and surrounding Upstate communities—such as Greer, Taylors, Simpsonville, Travelers Rest, Spartanburg, Anderson, and Landrum—regularly use VA loans to purchase primary residences.

VA loans are backed by the U.S. Department of Veterans Affairs, but eligibility determination happens before you ever choose a home. Understanding eligibility early helps you shop with confidence and avoid surprises during underwriting.

🎖️ Basic VA Loan Eligibility Requirements

VA loan eligibility is based on service status, not credit score alone.

You may qualify if you are:

- Active-duty service member

- Veteran who meets minimum service requirements

- National Guard or Reserve member with qualifying service

- Surviving spouse of a service member who died in the line of duty or from a service-related cause

Eligibility rules vary slightly by service era and discharge status, but many borrowers qualify sooner than expected.

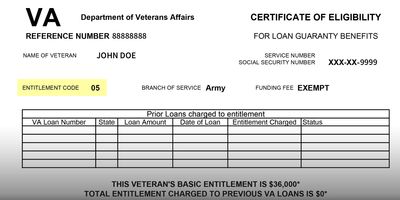

📄 Certificate of Eligibility (COE) Explained

Most VA borrowers must have a Certificate of Eligibility (COE). This document confirms to lenders that you meet VA service requirements.

Your COE shows:

- Your eligibility status

- Available VA entitlement

- Whether entitlement has been used before

Obtaining a COE is a standard part of the VA loan process, and many borrowers don’t need to request it themselves. It can often be verified electronically during pre-approval.

🔁 Can You Use a VA Loan More Than Once?

Yes. VA loans are reusable, not a one-time benefit.

You may still be eligible if you:

- Currently have a VA loan

- Previously paid off a VA loan

- Sold a home purchased with a VA loan

- Refinanced a previous VA loan

Available entitlement depends on prior VA loan usage and loan amounts, which is why a local review is important—especially in Greenville’s competitive housing market.

🏠 Property & Occupancy Eligibility Rules

To use a VA loan the home must meet VA guidelines.

VA loans require:

- The property must be a primary residence

- The home must meet basic safety and livability standards

- Eligible property types include:

- Single-family homes

- Townhomes

- VA-approved condominiums

- Single-family homes

VA loans cannot be used for vacation homes or investment properties.

⚠️ Common VA Eligibility Misunderstandings

Veterans across Upstate South Carolina often delay using their benefit due to misinformation:

- ❌ “I make too much to qualify”

- ❌ “VA loans are only for first-time buyers”

- ❌ “I used my VA loan once, so I can’t again”

- ❌ “Guard or Reserve service doesn’t count”

- ❌ “My discharge automatically disqualifies me”

Many of these assumptions are incorrect. Eligibility often depends on details that deserve a proper review.

❓ VA Loan Eligibility FAQs

Do I have to be a first-time home buyer to use a VA loan?

No. VA loans are available to both first-time and repeat buyers.

Does VA eligibility depend on income?

No. Eligibility is based on service history, not income level.

Can National Guard or Reserve members qualify?

Yes, many Guard and Reserve members qualify with sufficient service.

Do surviving spouses qualify for VA loans?

Some surviving spouses may qualify, depending on circumstances.

Does eligibility change by location?

No. VA eligibility is federal, but local market guidance matters when applying it in places like

Greenville, Greer, or Simpsonville.

🔗 Related VA Loan Resources

- VA Home Loans

- VA Loan vs Conventional Loan Comparison

- First-Time Home Buyer Programs in Greenville SC

- Veteran Mortgage Options in South Carolina

📞 Talk With a Local VA Loan Specialist

If you’re unsure about your VA loan eligibility, a quick review can bring clarity.

Jed Barker and Best Life Mortgage help veterans across Upstate South Carolina understand eligibility, entitlement, and next steps—clearly and without pressure.

📱 Call or text 864-800-9251 when you’re ready.

Best Life Mortgage

VA Loan Guidance | Greenville, South Carolina

Serving Veterans Throughout Upstate South Carolina with clarity and care

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.